The Magnificent 7 dominated 2023. Will the rest of the stock market soar in 2024?

2023 will go down in history for the start of a new bull market, albeit a strange one.

Despite some year-end catch-up by the rest of the S&P 500 index, megacap technology stocks, characterized by the so-called Magnificent Seven, have dominated gains for the large-cap benchmark

,

which is up 23.8% for the year through Friday’s close.

That’s the result of “extreme speculation,” according to Richard Bernstein, CEO and chief investment officer of eponymously named Richard Bernstein Advisors. And it sets the stage for investors to take advantage of “once-in-a-generation” investment opportunities, he argued, in a phone interview with MarketWatch.

MarketWatch’s Philip van Doorn last week noted that, weighting the Magnificent Seven — Apple Inc.

AAPL

, Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

Alphabet Inc.

GOOG

GOOGL,

Tesla Inc.

TSLA,

and Meta Platforms Inc.

META

— by their market capitalizations at the end of last year, the group had contributed 58% of this year’s roughly 26% total return for the S&P 500, and that’s down from a breathtaking 67% at the end of November.

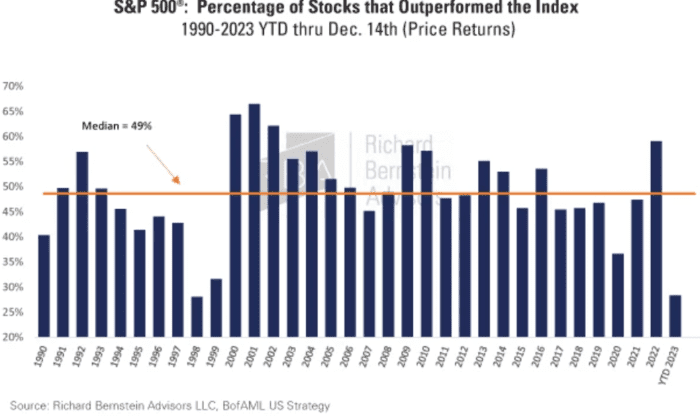

The chart below shows that the percentage of stocks in the S&P 500 that have outperformed the index in the year to date remains well below the median of 49% stretching back to 1990:

Richard Bernstein Advisors

Meanwhile, the tech-heavy Nasdaq Composite

has soared more than 40% this year, while the more cyclically weighted Dow Jones Industrial Average

,

which hit a string of records this month, is up 12.8%.

The narrowness of the rally gave some technical analysts pause over the course of the year. They warned that that it was uncharacteristic of early bull markets, which typically see broader leadership amid growing confidence in the economic outlook.

Bernstein, previously chief investment strategist at Merrill Lynch, sees parallels with the late-1990s tech bubble, which holds lessons for investors now.

The market performance indicates investors have convinced themselves there are only “seven growth stories,” he said. It’s the sort of myopia that’s characteristic of bubbles.

The consequences can be dire. In the 1990s, investors focused on the economy-changing potential of the Internet. And while those technological advances were indeed economy-changing, an investor who bought the tech-heavy Nasdaq at the peak of the bubble had to wait 14 years to get back to break-even, Bernstein noted.

Today, investors are focused on the economy-changing potential of artificial intelligence, while looking past other important developments, including reshoring of supply chains.

“I don’t think anyone is arguing AI won’t be an economy-changing technology,” he said, “ the question is, what’s the investing opportunity.”

For his part, Bernstein argues that small-cap stocks; cyclicals, or equities more sensitive to the economic cycle; industrials; and non-U.S. stocks are all among assets poised to play catch-up.

“I don’t think one has to be overly sexy on this one…it may not make a huge difference as to how you decide to execute and invest” in those areas, he said. “There’s a bazillion different ways to play this.”

Those areas are showing signs of life in December. The Russell 2000

,

the small-cap benchmark, has surged more than 12% in December versus a 4.1% advance for the S&P 500. The Russell still lags behind by a wide margin year to date, up 15.5%, or more than 8 percentage points behind the S&P 500.

Meanwhile, an equal-weighted version of the S&P 500

,

which incorporates the performance of each member stock equally instead of granting a heavier weight to more valuable companies, has also played catchup, rising 6.2% in December. It’s now up 11% in 2023, still lagging behind the cap-weighted S&P 500 by more than 8 percentage points.

Bernstein sees early signs of broadening out, but expects it to be an “iterative process.” What investors should be aiming for, he said, is “maximum diversification,” in direct contrast to 2023’s historically narrow market, which reflects investors rejecting the benefits of diversification and taking more concentrated positions in fewer stocks.

To be sure, while the Magnificent Seven-dominated stock-market rally has attracted plenty of attention, it doesn’t mean those individual stocks have been the sole winners in 2023.

“I will say, ‘magnificent’ is in the eye of the beholder,” said Kevin Gordon, senior investment strategist at Charles Schwab, in a phone interview.

The seven stocks that account for such a large share of the S&P 500’s gains do so mostly due to their extremely “mega” market caps rather than outsize price gains. And that’s just, by definition, how market-cap-weighted indexes work, analysts note.

That doesn’t mean the megacap stocks are necessarily the best performers over 2023. While Nvidia, up 243%, and Meta, up 194%, top the list of year-to-date price gainers in the S&P 500, Apple Inc.

AAPL

is only the 59th best performing stock, with a 49% gain. Combine that with a $3 trillion market cap, however, and Apple proves one of the biggest movers of the overall index.

What was bizarre about the 2023 rally wasn’t so much the megacap tech performance, Gordon said, but the fact that the rest of the market languished to such a degree until recently.

Clarity around the economic outlook and interest rates help clear the way for the rest of the market to play catch-up, he said. Fears of a hard economic landing have faded, while the Federal Reserve has signaled its likely finished raising rates and is on track to deliver rate cuts in 2024.

For stock pickers that didn’t latch on to the few winners, 2023 was brutal. Passive investors who just bought S&P 500-tracking ETFs should feel good.

So why not just chase the index? Bernstein argues that could spell trouble if the megacap names are due to falter. That could make for a mirror image of this year where gains for a wider array of individual stocks is offset by sluggish megacap performance.

Gordon, however, played down the prospect of “binary outcomes” in which investors sell megacaps and buy the rest of the market.

If troubled segments of the economy, such as the housing sector, recover in 2024, investors “could definitely see a scenario where the rest of the market catches up but it doesn’t have to be at the expense of highfliers,” he said.

from Stock Market News – My Blog https://ift.tt/WQV7LSp

via IFTTT