For many who park their cash in financial savings accounts, there’s been nothing however excellent news these days as rates of interest climb ever increased. Only a few years in the past, it was getting tough to search out banks that paid greater than 1%. Now, some are providing charges that high 4%.

However many People are failing to reap the benefits of the state of affairs — and they’re shedding out on the flexibility to earn lots of, if not 1000’s, of {dollars} in curiosity yearly.

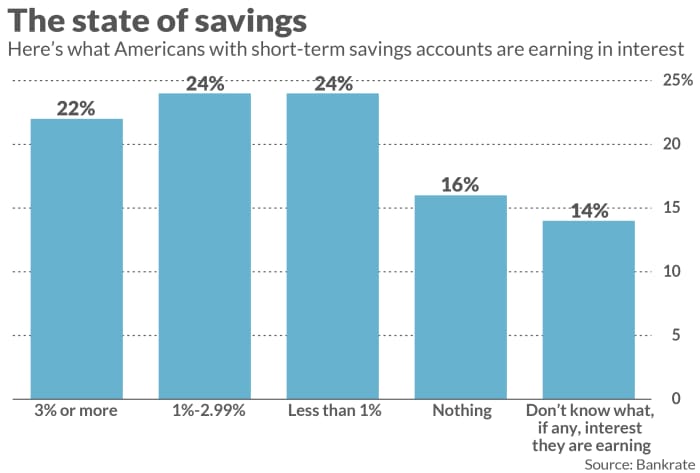

That’s the important thing discovering from a brand new Bankrate survey. It famous that simply 22% of these with a financial savings account are incomes 3% or extra, whereas 24% are incomes lower than 1%.

And 16% are incomes nothing.

In actual fact, some don’t even appear to care what their financial institution is paying out: Bankrate stated it discovered that 14% “don’t know what, if any, curiosity they’re incomes” on their financial savings.

And remember that these are individuals who have financial savings accounts. As Bankrate additionally famous, 33% of People general lack any short-term financial savings, interval.

So, why aren’t extra People being savvier when deciding the place to place their cash? Bankrate chief monetary analyst Greg McBride informed MarketWatch that various factors are accountable.

The high-yield financial savings accounts are sometimes online-only ones — and a few savers might want the consolation of realizing that they’ll go to a neighborhood department, he stated. However McBride factors out that financial savings accounts are often linked to checking accounts — so savers can nonetheless decide to have their checking with an establishment that has a brick-and-mortar presence, whereas incomes extra curiosity with their financial savings on-line.

“We’re not speaking about transferring all of your accounts to a web based financial institution,” McBride stated.

One other issue could also be simply sheer inertia, McBride famous. That’s, individuals usually follow the identical financial institution as a result of it’s a matter of consolation. Or, as McBride stated, that they had develop into so accustomed to charges being so meager for therefore lengthy that they stopped on the lookout for higher alternatives.

“We bought lulled to sleep in an surroundings of low-interest charges,” he stated.

Clearly, that’s not the case. And McBride stated it’s all of the extra disappointing that People aren’t seizing the chance to change to banks providing increased charges when lots of the establishments characteristic what he calls “no excuses” accounts — that means ones that don’t even require a minimal deposit.

Brent Weiss, head of monetary wellness at Aspect, a agency that gives monetary recommendation through an annual membership, stated the Bankrate survey speaks to “a monetary literacy disaster” — one which prices People billions of {dollars} every year merely due to their lack of expertise.

“Sadly, we’re treating it just like the local weather disaster,” Weiss stated. “The information is actual. The science is actual. And but we aren’t taking this risk to the monetary well being of on a regular basis People significantly.”