The utility and actual property sectors are most in danger from the top of straightforward cash, however more healthy family stability sheets ought to assist consumer-facing shares, say strategists at Evercore ISI.

The worldwide surge of inflation “has compelled the Fed and international central banks to hike charges at a report tempo,” Evercore’s fairness and derivatives technique group, led by Julian Emanuel, stated in a word that printed over the weekend.

The quicker tempo of inflation and better central financial institution coverage charges has clobbered bond costs and compelled up yields.

“The tip of the 40-year bond bull market and ensuing surge in borrowing prices poses dangers to leveraged gamers which have grown accustomed to low price debt,” stated the strategists.

This can be notably problematic for these sectors that have a tendency to hold larger ranges of debt, also called being extremely leveraged.

“As charges have risen, market yields are actually nicely above present coupon charges, suggesting corporates that rely closely on debt are prone to see a step up of their efficient curiosity bills.”

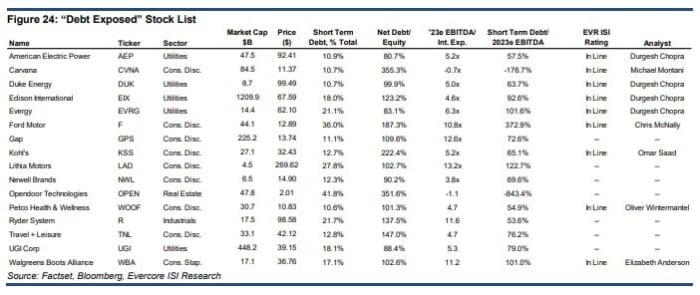

Sectors most in danger from this state of affairs — what Evercore dubs the “Debt Uncovered” — are utilities, actual property and telecommunications, as a result of they “at present garner the very best leverage and lowest EBITDA protection which may pose draw back to EPS if charges stay larger for longer.”

Supply: Evercore ISI

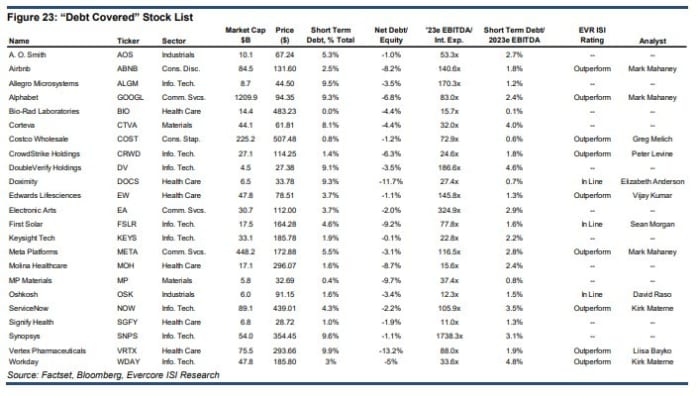

The sectors comparatively extra immune for larger rates of interest — the “Debt Coated” — are data expertise, power and healthcare.

Supply: Evercore ISI

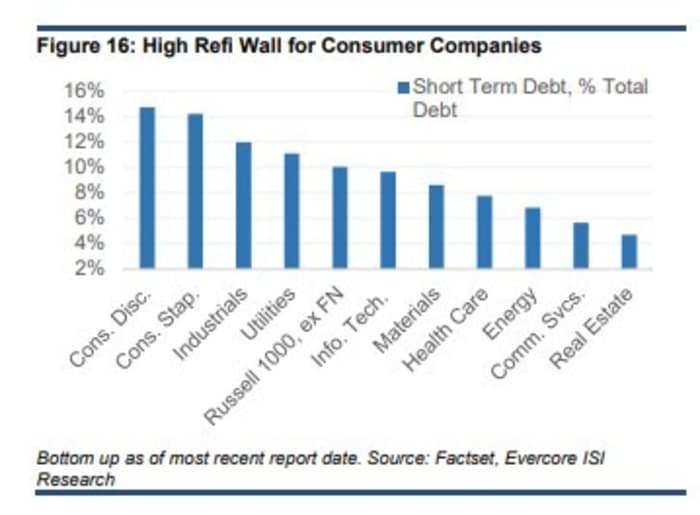

Evercore additionally notes that shopper discretionary and shopper staple corporations face issues from larger rates of interest as a result of they’ve a big proportion of short-term debt that may quickly want refinancing.

Supply: Evercore ISI

Nonetheless, these sectors will probably be supported by the spending of households sporting comparatively wholesome stability sheets.

“[H]ouseholds have remained comparatively sheltered from rising rates of interest. Deleveraging because the GFC [global financial crisis] is predicted to have lowered households’ rate of interest sensitivities. Steadiness sheets have improved throughout practically all revenue quintiles,” stated Evercore.