Pack Up and Go together with These 2 Journey Shares – TipRanks

The journey business is definitely cyclical, and a weak financial system may scare some of us away from journey shares. But, I invite you to pack up your luggage and make a journey with me as we discover two inventory picks — EXPE and RCL — for adventurous buyers.

Sadly, the post-pandemic journey increase pale in 2022, and elevated inflation compelled some shoppers to delay journeys. Nonetheless, inflation has already declined from its mid-2022 peak, and there’s room for some journey shares to fly larger this yr. So, listed here are a pair of journey inventory picks, EXPE and RCL, so as to add to your itinerary.

Let’s say you don’t need to wager your hard-earned capital on one explicit airline or resort. As a substitute, you would think about Expedia, a platform the place consumers guide flights, resort stays, and extra.

EXPE inventory bought slammed final yr, falling from over $200 at one level to lower than $100. The end result, although, is that Expedia’s price-to-sales (P/S) ratio is kind of cheap at 1.6x; I like a P/S ratio to be under 5x, and I consider something under 3x is within the cut price zone.

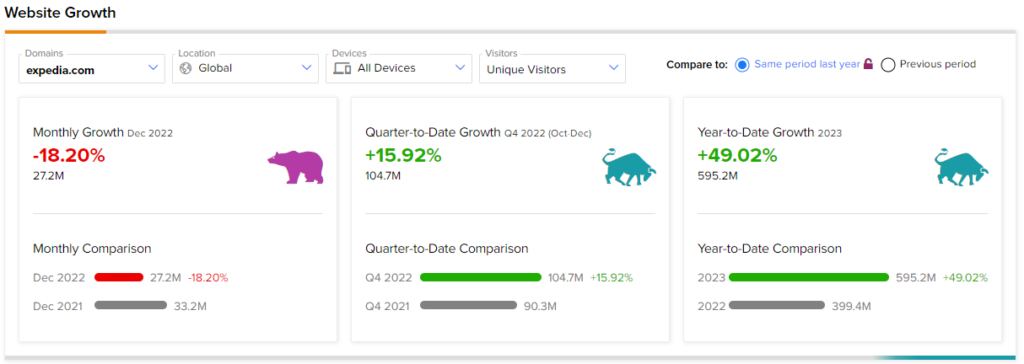

Plus, right here’s a reality I’ll guess you didn’t know: Expedia’s year-to-date web site visitors for 2023, at round 595.2 million distinctive guests, is up 49.02% year-over-year. This can be a optimistic signal, as web site visitors is a reasonably dependable indicator of curiosity in a services or products.

Even whereas EXPE inventory dissatisfied buyers final yr, Expedia’s monetary efficiency wasn’t horrible, particularly through the third quarter. Impressively, Expedia reported report quarterly income that was up 22% year-over-year, in addition to report third-quarter lodging bookings. Furthermore, Expedia’s web revenue elevated 33% year-over-year in Q3 2022 – not too shabby, contemplating this was a time of excessive inflation.

As well as, Oppenheimer analyst Jed Kelly set his sights excessive with a $120 value goal on Expedia inventory. Kelly additionally upgraded the inventory from Carry out to Outperform, with Oppenheimer analysts assuring that ” [online-travel booking] traits stay sturdy on pent-up demand and a resilient client.” Now, let’s see how different analysts really feel about EXPE inventory’s future prospects.

What’s the Value Goal for EXPE Inventory?

EXPE has a Average Purchase consensus score primarily based on 10 Buys, 9 Holds, and one Promote score assigned up to now three months. The common Expedia inventory value goal of $124.05 implies 7.2% upside potential.

If the way forward for on-line journey reserving appears vivid, what about cruises? Like EXPE inventory, RCL inventory was a poor performer final yr. Like Expedia, nonetheless, Royal Caribbean delivered surprisingly sturdy outcomes throughout 2022’s third quarter. After many consecutive quarters of destructive EPS, Royal Caribbean posted EPS of $0.26 (optimistic, not destructive) in Q3 2022. That end result beat the analyst consensus estimate of $0.20, as properly.

Moreover, Royal Caribbean’s year-to-date 2023 web site visitors is roughly 74.7 million distinctive guests, up 97.48% in comparison with the identical interval in 2022. Clearly, there’s been a surge in potential vacationers who could also be thinking about reserving a cruise; now, it’s as much as Royal Caribbean to transform its web site surfers into paying clients.

One other factor in widespread with Expedia is that Royal Caribbean has a really cheap P/S ratio. Certainly, Royal Caribbean’s P/S ratio of two.2x suggests a attainable cut price, and this could pique the curiosity of worth seekers – albeit ones with an urge for food for threat and volatility.

Regardless of the uneven seas of 2022, Royal Caribbean truly ended the yr with a present of energy. Notably, Royal Caribbean division Movie star Cruises posted its best day ever when it comes to Black Friday bookings after which its strongest Cyber Monday ever final yr.

On high of all that, Royal Caribbean Worldwide reported that Black Friday of 2022 was “the cruise line’s single largest reserving day in its 53-year historical past.” This, evidently, was the “third time the report was damaged in 2022 and the height of what’s now the model’s highest quantity reserving week.” That’s definitely a milestone second for Royal Caribbean, so now let’s test in to see what Wall Avenue’s specialists take into consideration RCL inventory.

What’s the Value Goal for RCL Inventory?

RCL has a Average Purchase consensus score primarily based on 5 Buys, three Holds, and one Promote score assigned up to now three months. The common Royal Caribbean value goal of $71.89 implies % upside potential.

The Takeaway: Attempt These 2 Journey Shares for the Lengthy Haul

Final yr was a bust for journey shares, however P/S ratios point out there could also be a few prime bargains for long-term buyers. Additionally, web site visitors and different knowledge level to a possible bump in journey curiosity and unexpectedly sturdy monetary performances from Expedia and Royal Caribbean. Subsequently, for those who can deal with what could be a turbulent 2023, think about a place in EXPE and RCL inventory.

Be a part of our Webinar to find out how TipRanks promotes Wall Avenue transparency

from Stock Market News – My Blog https://ift.tt/mKYUXBt

via IFTTT