TipRanks ‘Good 10’ Listing: These 2 Inventory Giants Look Compelling at Present Ranges – Yahoo Finance

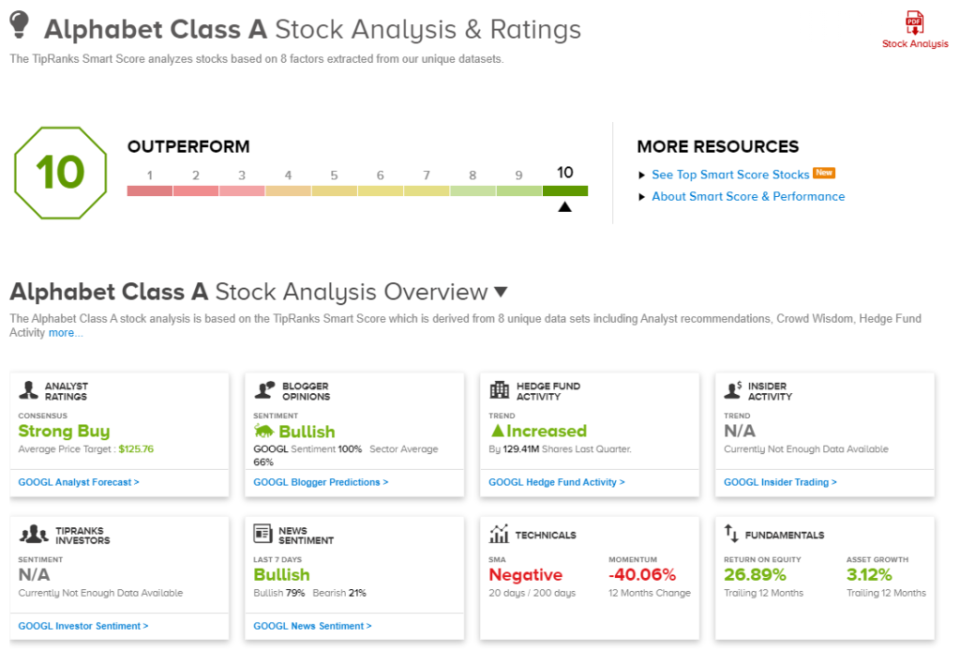

Recognizing the best shares is a talent that each investor must be taught, and the sheer quantity of market knowledge, on the primary indexes, on particular person shares, on and from inventory analysts, can current an intimidating barrier. Happily, there are instruments to assist. The Good Rating is an information assortment and collation software from TipRanks, utilizing an AI-powered algorithm to kind the info on each inventory based on a sequence of things, 8 in all, which might be identified for his or her sturdy correlation with future share outperformance.

That every one seems like a mouthful, however it boils right down to this: a classy knowledge software that offers you a easy rating, on a 1 to 10 scale, to evaluate the prospects of any given inventory. It places the advanced world of inventory market knowledge at your fingertips.

The Good 10, in fact, must be a superb neon signal put up guiding traders in for a more in-depth look – and generally, it guides traders towards shares which have by no means lacked for headline or discover. These are a few of the market’s giants, shares which might be family names, function trillion-dollar market caps, and boast Robust Purchase consensus scores from the Avenue’s greatest skilled analysts. So, let’s give two of them a more in-depth look.

Microsoft Company (MSFT)

First up on our listing is Microsoft, one of many best-known model names on the earth – and likewise the second-largest publicly traded firm on the earth, with a market cap of $1.78 trillion. Microsoft acquired its begin again within the mid-70s, and was a part of the preliminary growth of the non-public pc tech revolution. The corporate rose to prominence when its Home windows working system grew to become the business commonplace, nonetheless used at present, for almost all of all private computing.

As we speak, the corporate is adapting efficiently to the rising cloud computing atmosphere, providing merchandise corresponding to Workplace 365, which brings the Workplace functions for dwelling, faculty, and small enterprise use onto the cloud; Dynamics 365, which does the identical for enterprise functions; and the Azure platform to assist cloud computing operations. On the identical time, the corporate maintains service and assist for its extra trendy Home windows working methods.

Within the final reported quarter, Q1 of fiscal 12 months 2023 (September quarter), Microsoft reported $50.1 billion on the prime line. This translated to a ten% enhance year-over-year, and beat the $49.6 billion forecast. The stable consequence got here on the again of a 24% reported enhance in cloud income, to $25.7 billion, or barely greater than half of the entire.

On the unfavorable facet, the corporate reported a y/y drop in web earnings, by 14% to $17.6 billion, with the diluted EPS falling 13% to $2.35 per share. The true hit for traders got here from the corporate’s fiscal Q2 steerage, which was set at $52.35 billion to $53.35 billion, or up 2% on the midpoint. This was, nevertheless, under the $56.05 billion analysts had wished to see – and the inventory fell after the earnings launch.

Morgan Stanley’s Keith Weiss, nevertheless, stays bullish on the corporate’s prospects. The 5-star analyst writes, “Whereas traders fear ahead numbers haven’t been de-risked, we see a powerful (and sturdy) demand sign within the industrial companies, which ought to result in bettering income and EPS development in 2H23…. The energy of Microsoft’s positioning throughout key secular development segments stays unchanged. Combine shift towards quicker rising Azure and Dynamics 365 and comparatively sturdy Workplace 365 development (in fixed foreign money) assist assist administration’s objective of 20% fixed foreign money development throughout its Business companies.”

In Weiss’s view, Microsoft’s potential absolutely deserves its Chubby (Purchase) score, and his $307 value goal implies a one-year upside potential of 29%. (To observe Weiss’s observe document, click on right here)

General, Microsoft inventory has picked up 27 current scores from Wall Avenue’s analysts, a complete that features 25 Buys in opposition to simply 2 Holds – for a Robust Purchase consensus score. The shares are priced at $238.73, and their common goal of $291.34 suggests a 22% acquire on the one-year time horizon. (See MSFT inventory evaluation on TipRanks)

Alphabet, Inc. (GOOGL)

Subsequent up is Alphabet, the guardian firm of Google, that everybody is aware of. The world’s largest search engine is a part of an total agency that boasts a $1.16 trillion market cap, making it the third largest publicly traded agency, after Microsoft and Apple. Alphabet isn’t simply Google; the corporate additionally owns the Android OS, the favored YouTube web site, and is even transferring into the autonomous automobile area of interest by its Waymo subsidiary.

Whereas Alphabet stays close to the highest of the worldwide tech business, the current 3Q22 confirmed some cracks that can must be addressed. For probably the most half, these are associated to normal financial circumstances, notably shrinking promoting budgets within the on-line business. The corporate’s Q3 outcomes confirmed complete revenues of $69.09 billion, up 6% year-over-year – however that modest development represents a definite deceleration from the prior 12 months’s 41% development price, and it missed the $70.5 billion forecast. Working margins additionally fell, from 32% one 12 months in the past to 25% within the final quarter; working earnings was down 18% to $17.13 billion.

The miss in income was exacerbated by a big miss in YouTube’s prime line. Promoting income on the video web site got here in at $7.07 billion, lacking the $7.42 billion forecast by a 4.7% margin.

Whereas there are severe headwinds going through Alphabet/Google, we must always not underestimate the corporate’s clear strengths. Google stays the web’s premier search engine, and Google Search accounted for greater than $39.5 billion of the entire income. And, regardless of the pullback in total internet advertising, Google Adverts noticed income’s absolute numbers develop by $1.3 billion y/y, to $54.4 billion (a complete that features Google Search’s acquire, in addition to the pullback in YouTube promoting). Lastly, the corporate boasts deep pockets, with over $21.9 billion in money property readily available. Briefly, Alphabet has each the market place and the sources to climate a storm.

Mark Mahaney, 5-star analyst with Evercore ISI, is cognizant of GOOGL’s difficulties within the on-line advert section going ahead. But, whereas he predicts brief time period ache he additionally sees long run acquire: “For now, we estimate GOOGL’s natural income development deteriorating additional to six% Y/Y in This fall, earlier than starting to recuperate someday in ‘23. However after the Macro and the FX and the Comps, we strongly imagine GOOGL will re-emerge because the broadest, strongest world advert income platform, with a dramatically worthwhile enterprise mannequin, notable diversification into Cloud Computing, and substantial long-term possibility worth with Waymo.”

Quantifying his stance on GOOGL, Mahaney charges it as Outperform (a Purchase) for the 12 months forward and backed by a $120 value goal that means a 34% upside potential from present ranges. (To observe Mahaney’s observe document, click on right here)

All of Mahaney’s colleagues agree along with his thesis. GOOGL shares rating a unanimous Robust Purchase consensus score, based mostly on 29 current optimistic analyst evaluations. The inventory’s common value goal, $125.76, signifies potential for 41% development from the present buying and selling value of $89.23 over the approaching 12 months. (See GOOGL inventory evaluation on TipRanks)

Keep abreast of the greatest that TipRanks’ Good Rating has to supply.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.

from Stock Market News – My Blog https://ift.tt/HmuwlPx

via IFTTT