Clutch of rising markets buck development with large ETF outperformance – Monetary Instances

Newest information on ETFs

Go to our ETF Hub to search out out extra and to discover our in-depth information and comparability instruments

Monetary markets might have slumped throughout many of the world in 2022, however a handful of nations are on observe to see progress in trade traded fund property regardless of the headwind of plummeting valuations.

The resilience attests to the rising adoption of ETFs across the globe — significantly in some rising market economies the place uptake has lagged behind extra developed nations — in addition to some pockets of resistance in monetary markets themselves.

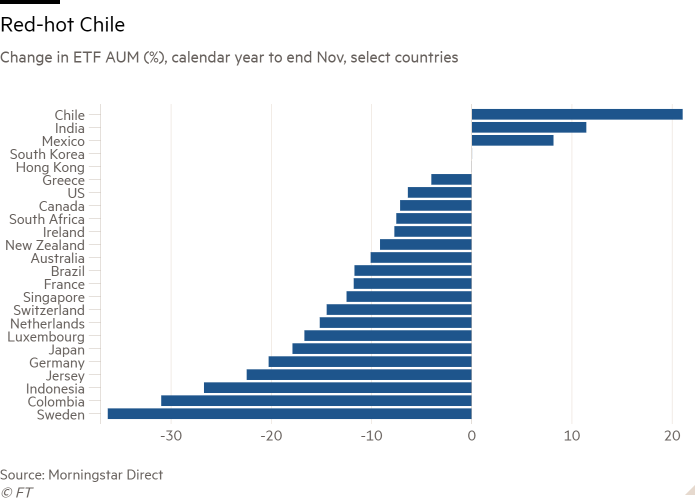

As of the tip of November, Chile, India, Mexico and (simply) South Korea have been on observe to document year-on-year ETF asset progress, in keeping with information from Morningstar Direct, whilst international ETF property fell 7.6 per cent from $10.3tn to $9.5tn, in keeping with ETFGI, a consultancy.

The declines have been sharper nonetheless in some instances. The property of Swedish-listed ETFs tumbled 36.3 per cent to $6.3bn within the first 11 months of 2022, in keeping with Morningstar because the MSCI Sweden fairness index slid an outsized 27.3 per cent in greenback phrases.

The Colombian ETF market noticed a 31 per cent contraction to $1.4bn as internet inflows worsened a 12.4 per cent inventory market fall in greenback phrases, whereas Indonesia’s tiny market managed to shrink even additional, by 26.7 per cent to $358mn, because of internet outflows — regardless of a 9.1 per cent inventory market rise.

Among the many bigger markets, property of US-listed ETFs have fallen by 6.4 per cent to $6.8tn, in keeping with Morningstar, these of Irish-listed automobiles by 7.7 per cent to $964bn and people of Japan by 17.9 per cent to $446bn. Luxembourg-listed ETFs have contracted by 16.7 per cent to $281bn and Canada has seen a 7.1 per cent decline to $254bn.

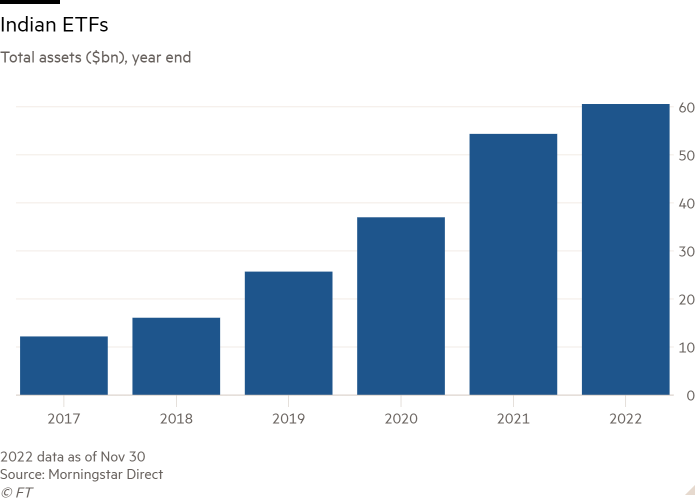

There have been pockets of progress for the trade, although, maybe mainly amongst them India, the place ETF property have risen 11.4 per cent this 12 months to $60.6bn, regardless of the inventory market making small losses in greenback phrases.

“India has seen large progress in index merchandise, each ETFs and mutual funds,” stated Deborah Fuhr, managing companion and founding father of ETFGI. “It has actually seen an awakening by way of progress of index merchandise monitoring the Nifty 50 [equity] index.”

Kenneth Lamont, senior fund analyst for passive methods at Morningstar, stated India was one of many extra “fascinating” ETF trade progress tales, with a minimum of 15 ETFs, each fairness and glued earnings, receiving $100,000 or extra in internet inflows up to now this 12 months.

“We’re late within the race however we’re catching up,” stated an official for NSE Indices, a subsidiary of the Nationwide Inventory Change of India. “The index fund as an idea could be very in style in India and it’s rising.”

The nation’s ETF property have quintupled since December 2017, once they have been a mere $12.2bn, in keeping with Morningstar, the second-fastest price of progress on the planet, behind solely Chile.

The official dated the beginning of the trade’s progress spurt to 2015, when complete property in fairness and bond ETFs have been a “minuscule” $1bn, regardless of the primary Indian ETF having launched in 2001.

That 12 months, the Workers’ Provident Fund Organisation, which administers India’s obligatory pension fund, began pumping 5 per cent of incremental investments into fairness ETFs monitoring the Nifty 50 and Sensex 30 indices. This was later tripled to fifteen per cent.

“That was the driving power of the ETF trade taking off,” the official stated. “As soon as they began investing, the trade has grown in leaps and bounds and retail buyers have additionally began investing in passive funds.”

India now boasts 294 passive funds, up from simply 84 in March 2017, in keeping with information from the Affiliation of Mutual Funds in India, collated by NSE Indices, with the phase now accounting for about 15 per cent of complete fund trade property.

Some 16.3mn investor “folios” now embody ETFs, and three.1mn contain passive mutual funds, up from 1.3mn and 0.3mn respectively as lately as March 2019, in keeping with AMFI information collated by the trade.

“Many of the energetic funds, particularly within the giant cap class, are discovering it troublesome to outperform the underlying indices, so persons are switching from energetic to passive funds,” stated the official.

The opposite main success tales have been in elements of Latin America. Chile has seen the strongest asset progress this 12 months of any nation tracked by Morningstar, with AUM up 21 per cent to $4.1bn.

Web inflows have been a strong $919mn, the second-highest on document though a fraction of 2021’s $3.2bn, whereas a 22.4 per cent rise within the dollar-denominated MSCI Chile index can have helped these investing within the home inventory market.

Mexico is one other brilliant spot, with a mix of internet inflows and extra modest inventory market beneficial properties serving to propel an 8.2 per cent rise in property to $6.1bn.

Lamont emphasised that these markets remained small, and within the case of Chile most of inflows have been sucked up by only one fund, Singular International Corporates, which invests in dollar-denominated debt issued globally.

Nonetheless, the information, that are primarily based on the first itemizing of every ETF, most likely fails to seize the complete vigour of LatAm markets, Lamont stated, provided that many now allow the cross-listing of ETFs whose main itemizing is abroad.

Hector McNeil, co-founder and chief government of HANetf, which has cross-listed greater than 20 ETFs in Mexico, alongside others within the likes of Chile and Peru, stated there was “an enormous quantity of demand” for abroad property, corresponding to US Treasuries, hedged again into Mexican pesos, with the intention to restrict danger.

Furthermore, McNeil stated European-listed ETFs primarily based on the continent’s Ucits fund construction, have been extra tax environment friendly than each US-listed ETFs, which usually levy a withholding tax, and even direct holdings of Mexican bonds.

Click on right here to go to the ETF Hub

from Stock Market News – My Blog https://ift.tt/LiyHWnP

via IFTTT